Retirement planning usually isn’t at the forefront of our minds until we have to think about it. You might be thinking about how much you’ll need in later life if you’ve recently been automatically enrolled into your workplace pension. Or perhaps the arrival of your new grandchild has you thinking about the future.

If you’re wondering how much you’ll need to enjoy your golden years, you’re in the right place. In this guide, we’ll explore what the average UK pension pot looks like, what your options are at retirement and more.

How much retirement savings should I have?

We’ve all heard the HK Williams quote, “Remember, if you fail to prepare, you are preparing to fail”. This is certainly true for setting aside money for retirement. It likely won’t have been on your radar when you were younger, but the truth is that starting early is almost always a good idea.

Investing in your pension pot earlier gives it more time to grow. It also gives you a head start over your peers, meaning you won’t have to contribute as much to catch up. The reality is that many of us don’t start thinking about retirement until we have to. This could be when you've started a family or even joined a workplace pension.

Whatever your circumstances, it's never too early to start planning ahead for retirement. PensionBee's latest findings predicted the average pension pot value you could see at age 65, depending on what age you start paying into it.

- Under 30 years old: £140,700

- 30-39 years old: £135,900

- 40-49 years old: £112,900

- Over 50 years old: £87,500

How much should I pay into my pension pot?

Not sure where to start or even how much you should have in your pension pot by the time you reach 40? Many experts recommend that you aim to save enough so you’ll have around two thirds of your final salary as annual retirement income. You can work this out with a simple formula.

Take the age that you started paying into your pension and divide it by half. This figure is the percentage that you should aim to contribute until you retire - and also includes your employer’s contributions.

For example, if you started making contributions at age 34, your total contribution would be 17%. But, if your employer contributes 5%, you’ll only need to make up the remaining 12%. This may be difficult to achieve at first, but if you increase your contributions when you get a pay rise, it could make a big difference.

A Cost of Retirement survey from Which? revealed the average amount that retirees need to achieve an essential, comfortable and luxury retirement. They found that couples spend around £18,000 per year for the basics.

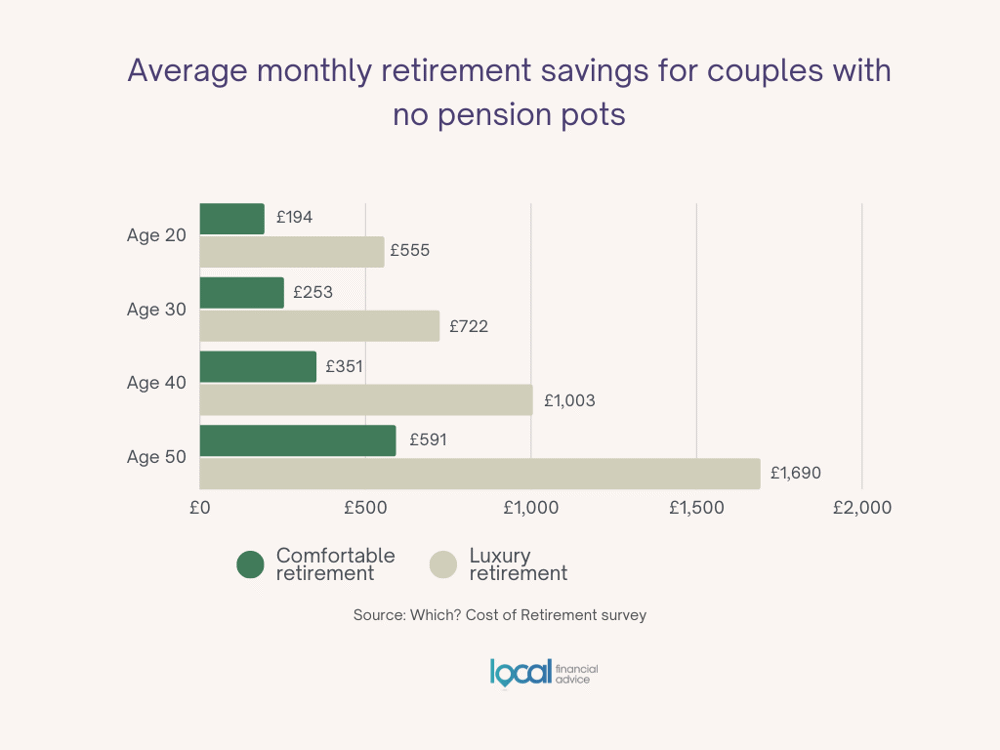

To afford a comfortable retirement, here’s what couples need to save per month to have a pension worth £154,700 if they have no other pension savings.

- Age 20: £194

- Age 30: £253

- Age 40: £351

- Over 50: £591

For luxury retirement, the survey revealed couples should aim to have £442,020 in their pension pot. To achieve this, you’ll need to save the following:

- Age 20: £555

- Age 30: £722

- Age 40: £1,003

- Age 50: £1,690

Not in a couple? Read our singles retirement guide to find out how to plan ahead for retirement.

How much do I need for retirement?

What makes a good retirement depends on who you talk to and what’s important to you. In this section, we’ll help you explore what that retirement means for you, including how to estimate your future expenses.

Determine what your target retirement income is

Now that you know the rule of thumb, you’ll need to set your own retirement goals to understand what to aim for. Thinking about the lifestyle you want to achieve will help. You might already have an idea of what that looks like. It could mean more travel or rediscovering hobbies such as painting or woodworking.

You’ll also need to consider how your day-to-day expenses will change. That early morning commute may mean you currently need to budget for petrol. But, it’s likely that you won’t use your car as much or have any mortgage repayments to make when you’re retired.

Now, it’s time to crunch some numbers. To calculate your target retirement income you’ll need to:

- Work out your current monthly outgoings - Include all essential and discretionary expenses.

- Deduct your essential expenses - Living in a one or two-person household could mean you’ll spend less on utility bills, food costs and day-to-day travel

- Deduct non-essential expenses such as meals out, holidays and entertainment - Estimate how much you’ll spend on the fun stuff.

You should now have a rough idea of what you might spend each month when you’re retired. Remember, we go through many changes in life. And considering you’ll have a lot less expenses and more free time, it could be an exciting new chapter in your life to enjoy.

What does the average UK pension pot look like?

According to the latest data from PensionBee, the average UK pension pot stands at £21,164, with a third (33%) of people reporting that they’re still making regular contributions.

Here are the average pension pot sizes, broken down by region:

- Northern Ireland: £14,972

- North West: £16,392

- Wales: £17,367

- North East: £17,684

- Scotland: £19,044

- East Midlands: £19,271

- West Midlands: £19,293

- South West: £20,723

- Greater London: £22,315

- South East: £27,584

How does your current projected pension pot value compare with the above figures? Of course, these figures don’t show the value at retirement age. If your current pension pot value doesn’t quite match up, or if you’re worried you won’t have enough, speak to a financial adviser.

Ways to increase your retirement income

Your personal or workplace pension is just one way you can save for the future. Here are a few more ways you can supplement your retirement income.

State Pension

You can get up to £185.15 per week if you qualify for the full New State Pension. This figure changes and rises to meet the inflation rate. And if you’re on a low income, you may be eligible for a top up with the Pension Credit. This could mean your income rises to £182.60 or £278.70 for couples.

Property or investments

Property opens up many opportunities for extra retirement cash. If you’re currently living in a large family home, you could rent or sell and downsize to a smaller home. But if you’d prefer to stay where you are, you could rent a room out. AirBnB is another option to consider too.

Equity release

When you pay off your mortgage, you increase its equity or value. But what if you could turn your home into a source of income? Equity release gives homeowners aged 55 and over an opportunity to release some of their home’s equity as tax-free cash.

How it works is that it’s a loan against your home that’s paid from the sale of your property when you go into care or die. If you’re eligible, it could free up thousands for you to spend on a more comfortable retirement, home improvements and more.

Phasing into or delaying retirement

There’s no rule that says retirement means giving up work - or that you have to retire at 65. You could transition into a part-time role to free up more time to spend with your family. And, if you’re not quite ready to slow down, you could move your retirement date back, giving your pension pot more time to grow.

What can you do with your pension pot at retirement?

The pension freedoms of April 2015 gave people more choices about what they could do with their defined contribution (DC) pensions. This means from age 55, you could:

- Leave your pension pot alone - giving it the potential to grow

- Take up to 25% of your pension pot tax-free - the rest will be subject to income tax

- Buy an annuity - get a guaranteed retirement income for life or a fixed term

- Drawdown your pension - get flexible access to your pension pot

- Combining the above options - for example, taking a lump sum and buying an annuity

As you can see, you have many options to consider at retirement. Without having a crystal ball, it can be difficult to determine how each option may affect your financial future. But, working with a financial adviser that specialises in retirement planning could help you determine the most suitable plan for your needs.

How financial advice could help you make the most of your pension savings

From helping you answer questions such as, ‘Can I afford to retire at age 55’ to taking advantage of tax credits, a financial adviser’s job is to help you get the most from your money.

Working with a pensions and retirement planning expert can help you explore your options by supporting you to:

- Understand your current financial position

- Set your personal retirement goal

- Calculate how much you’ll need for retirement

- Build a savings and/or investment plan to achieve your goal

- Compare your different options at retirement and explore the pros and cons of each

Think financial advice could work for you? Learn more about how our service can help you take the first step towards getting your retirement finances in order.

How our free service helps you connect to an expert

Our free adviser matching service gives you more time to spend on what matters. Designed around a simple form, our service makes it easy to connect with a local expert. Tell us what type of financial advice you’d like and your contact details, and we’ll match you with the expert with the right qualifications to suit your needs.

You’ll then receive a call from our friendly Yorkshire-based customer experience team. Once they confirm what you’re looking for, they’ll pass your details to your expert adviser. Finally, your expert will be in touch to arrange your free consultation, where you can learn more about your retirement options.

Click the button below to get started and match with your local retirement adviser.

Editor’s note: This article was published in January 2014 and has been updated for accuracy and freshness.